does tesla model y qualify for federal tax credit

All about the Tesla Model Y to complete Teslas S-3-X-Y lineup. Lets hope they approve an extended Federal Tax credit of 7500 for all until a date such as 2024.

Tesla Is Absolutely Crushing The Competition In California Thanks To The Model Y

The Plug-in Electric Drive Motor Vehicle Credit electric car tax credit is a short-term incentive to offset the initial higher purchase price of qualified vehicles.

. This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery. However Teslas can still qualify for up to 7500 in tax credits. Model 3 buyers who receive their cars in the quarter when Tesla delivers its 200000th US.

The Tesla Team 10 août 2018. First here are some Tesla vehicles that will qualify for the Tax Credit. 31 2019 no credit will be available.

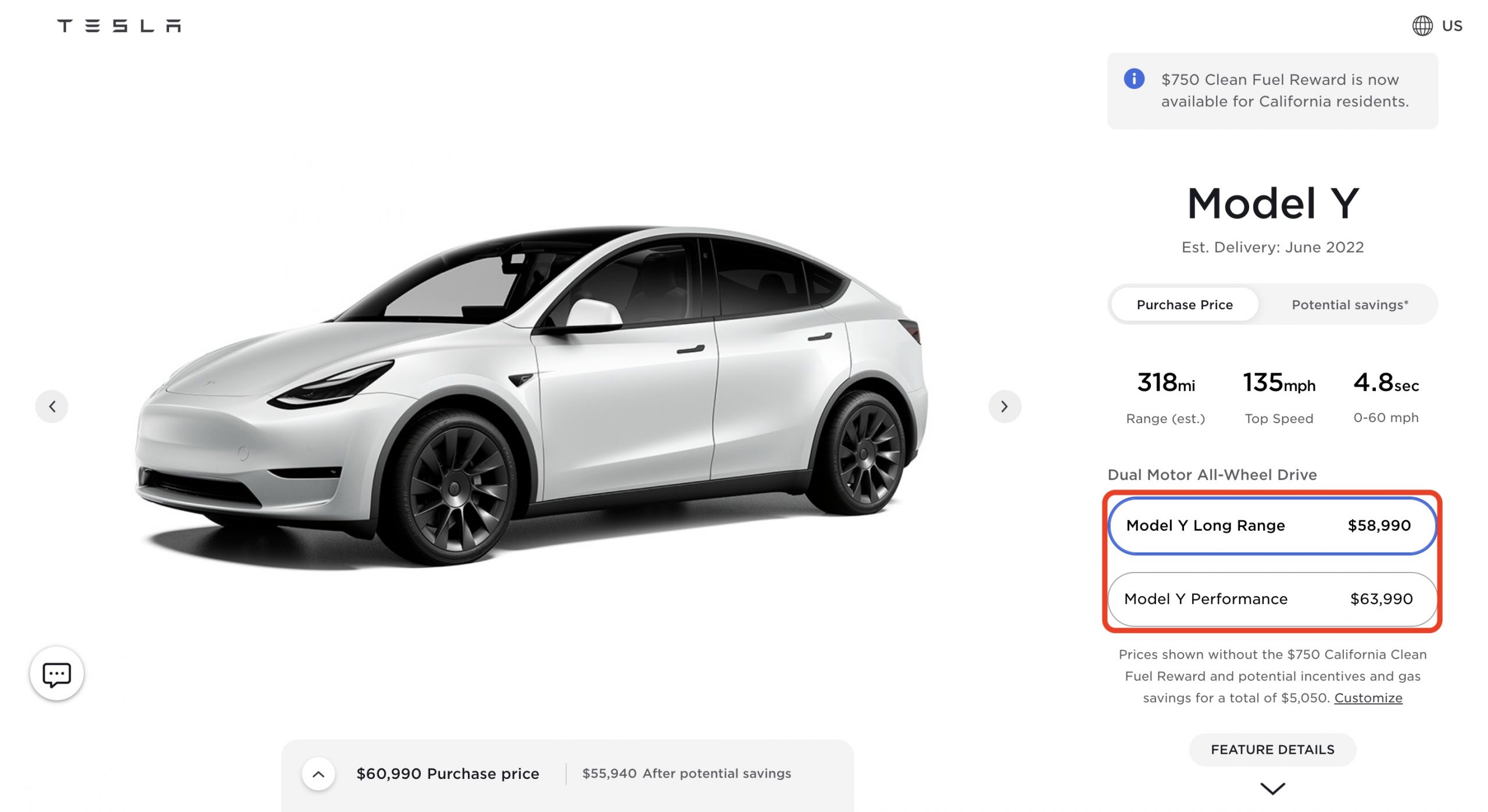

Entry level model S starts at 79690 Model 3 starts at 39690 Model Y starts at 51990 The Cyber Truck single. Apparently you can deduct up to 18100 the first year. 166 votes 269 comments.

Electrek noticed that Tesla has increased the price of the Model Y by 1000. This tax credit begins to phase out once a manufacturer has sold 200000 qualifying vehicles in the US. Currently state of California is offering 2500 credit.

Can Both New and Used Vehicles Qualify for Section 179. 1 2019 the credit will be 3750 for Teslas eligible vehicles. Tesla Model X Toyota 4Runner Landcruiser Sequoia Tundra Note.

For Teslas bought on or after January 1 2020 there has been no federal tax credit. This happened in 2018 and all new Teslas bought through the end of 2018 qualified for the 7500 tax credit. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

I did a little more digging on certain tax forms about bonus depreciation under 179 if the vehicle weighs less then 6000 lbs. Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the. The Tesla Model Y doesnt qualify for the 7500 federal tax credit for electric vehicles because the company has passed the 200000-unit.

Electric Vehicles Solar and Energy Storage. Thats because the last batch ever of Tesla electric vehicle buyers will receive a federal tax credit by the end of the year. On July 1 2019 the credit will be reduced to 1875 for the remainder of the year.

This includes US automakers like Tesla who topped over 200000 qualified plug-in electrics sold a few years ago and as a result no longer qualifies for any federal tax. Then require only new zero emission autos sold after 2050. 3750 for tax years 2025-26.

I just put the deposit for Tesla Model Y but holding to get delivery until 7000 federal credit. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer.

Qualifying vehicles by the manufacturer are eligible for a 7500 credit if acquired before Jan. Jun 27 2019. Tesla is at the tail end of a government incentive program for all EVs.

Vehicle will receive the full 7500 federal tax. As for Tesla it would earn partial credit for assembling the Model Y and Model 3 in the US though its workforce is not unionized. Like to know as soon as federal credit is.

It phased out in 2019 first reducing to 3750 and then to 1875. That should be fair sales for US buyers and from all auto manufactures sold in the US. Local and Utility Incentives.

360k members in the TeslaModelY community. Qualifying for a deduction will depend on stated use vehicle GVW which varies with trim packages and options and more. The qualified plug-in electric drive motor vehicle credit is a nonrefundable federal tax credit of up to 7500 according to Jackie Perlman principal tax research analyst at HR Blocks Tax.

Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7500 federal tax credit. Please consult with your accountant regarding the eligibility of any particular vehicle. Last month Tesla sold its 200000th such vehicle and since then weve heard from some.

Since the new law would take the tax credits off the price of an EV at the time of purchase Tesla is making moves to get more money upfront from its customers before getting the rest from Uncle Sam. Aspiring Tesla owners should pay close attention. I believe Anyway the new Tesla Model Y came out for the consumer and it is below 6000lbs which is the threshold for qualifying.

Tesla Model Y Launch Date And Pricing In Hong Kong Revealed

The Tesla Model 3 And Model Y Just Got More Expensive Overnight Thanks To Price Hike Techradar

Check Out This Tesla Model Y Review After 35 000 Miles

Tesla Model Y Gets 1 000 Price Increase As Delivery Estimates Get Later Into 2022

Tesla Model Y Features Prices Specs And More Electrek

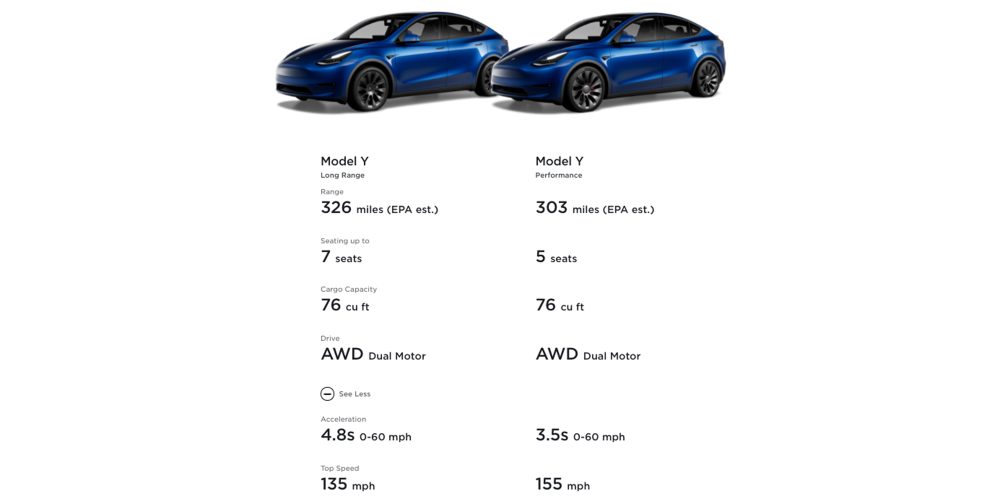

Tesla Model 3 Vs Model Y The Latest Generation Basics Compared Electrek

Tesla Model Y Gains Entry Level Standard Range Variant Newly Optional Third Row Carscoops

Tesla Model Y Features Prices Specs And More Electrek

Tesla Hikes Price Of Model 3 Model Y By 2 000

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

Tesla Model Y Features Prices Specs And More Electrek

2021 Tesla Model Y Review Autotrader

Tesla Model Y A New S U V Is Unveiled Amid Mounting Challenges The New York Times

Tesla Model Y Deliveries Imminent Time For Traditional Luxury Brands To Panic The Watt Car

Study Product Means More Than Gas Prices In Stoking Ev Demand

Tesla Model 3 Vs Model Y The Latest Generation Basics Compared Electrek

Tesla Model Y And Model 3 Dominates By Commanding About 2 3 Of Us Ev Market

2022 Tesla Model Y Long Range Awd Pg E Ev Savings Calculator

Tesla Model Y Delivery Inspection Checklist Tesla Checklist Model Y